📰 Lenskart Stock: Strong Business, But Valuation Raises Questions

💡 Company Snapshot

Lenskart Solutions Ltd is India’s largest organised eyewear retailer—covering design, manufacturing, branding and retailing of prescription glasses, sunglasses and contact lenses.

Its FY25 reported revenue was roughly ₹7,010 crore, with ~33.5% two-year CAGR and over 2,800 stores globally.

The company’s IPO in late 2025 raised significant attention: It targeted a valuation of ~₹70,000 crore (~US $8 billion) at an issue price of ₹382-402 per share.

📉 What’s Happening with the Stock

On its debut, the shares listed at ~₹390 on the NSE (below issue price of ₹402) and fell as much as ~11% shortly after.

Analysts have flagged valuation concerns: The price-to-earnings ratio works out to over 200× (or more when adjusted), which many consider stretched for a business still scaling.

Financial metrics show low return on equity and return on capital relative to the hype. Data: ROE ~4% (last 3 years); book value etc suggest moderate returns.

📋 Key Upsides

Large addressable market: Under-penetrated eyewear market in India + growing international presence.

Vertically integrated supply chain: Manufacturing in India, control over costs and speed (including next-day delivery) gives competitive edge.

Omnichannel business model: Stores + online + subscription/membership (“Lenskart Gold”) enhances customer stickiness.

⚠️ Key Risks & Things to Watch

Valuation risk: With high multiples, the margin for error is small. Any slowdown or competition could trigger sharp correction.

Profitability & margins: Although profitable in FY25, much of the gains came from one-time items; core margin remains thin and subject to cost inflation and competition.

Competitive threat: New entrants (domestic/overseas) and price pressures could impact market share and margin expansion.

Execution risk: Scaling stores, maintaining supply chain, international operations all require strong execution; past performance shows growth but also thin margins.

📌 Investment Takeaway

For investors considering Lenskart stock:

If you believe in the long-term eyewear growth story, brand strength and omnichannel retail, Lenskart offers exposure to a large niche with potential.

But if you're looking for a near-term trade with upside based on IPO “pop” or quick returns, risks may outweigh rewards at current valuation.

A prudent approach: Monitor upcoming quarterly results, margin trends, growth in international business and if the valuation gets reset to more reasonable levels.

You May Also Like

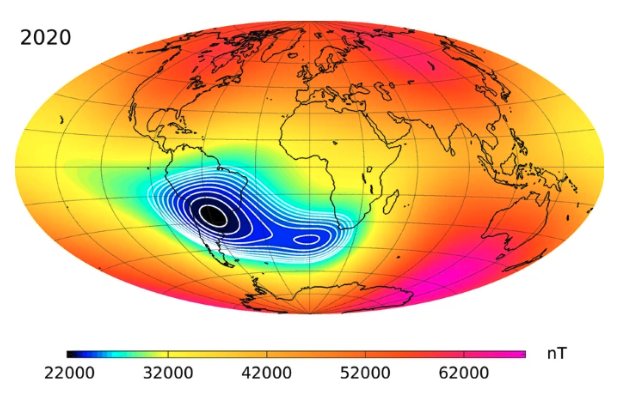

South Atlantic Anomaly (SAA)

1. What is the SAA?The South Atlantic Anomaly (SAA) is a region where the planet’s magnetic fie...

🚙 2000 Tata Sierra

🚙 Overview: 2000 Tata SierraThe Tata Sierra is a mid‑size SUV made by Tata Motors. Production...

national princess day wishes

👑 Sweet National Princess Day WishesHappy National Princess Day! May your day shine as bright...