Vijay Kedia's Stock Portfolio Performance in 2025: Multibaggers, Laggards, and Lessons from the Market Master

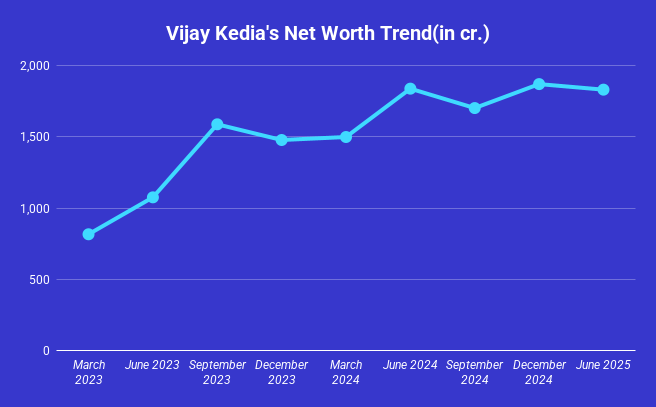

Ace investor Vijay Kishanlal Kedia, often hailed as the "Market Master," has built a reputation for spotting multibagger stocks in the small- and mid-cap space. With a net worth hovering around ₹1,400-1,600 crore as of mid-2025, his portfolio continues to draw attention from retail investors seeking inspiration. As of the latest disclosures (Q3 2025), Kedia holds stakes in 12-15 stocks, valued at over ₹1,345 crore, focusing on sectors like automotive, engineering, cybersecurity, and pharmaceuticals.

In 2025, his portfolio has been a mixed bag: strong Q2 results boosted gems like Atul Auto, while broader market volatility dragged others down by up to 51% YTD. Let's dive into the performance, top holdings, and what makes Kedia's strategy timeless.

Who is Vijay Kedia?

Born in 1959 in Kolkata, Kedia started trading as a teen with limited capital. Early losses taught him patience, leading to his famous SMILE principle: Small in size, Medium in experience, Large in aspiration, Extra-large in market potential. His breakthrough came in 2004-05 with bets on Atul Auto, Cera Sanitaryware, and Aegis Logistics—turning into 100x multibaggers over a decade.

Kedia bets on the "jockey" (management) more than the horse, holding stocks for 10-15 years if fundamentals hold. As of November 2025, his portfolio reflects this: diversified yet concentrated in high-conviction ideas.

Top Holdings and 2025 Performance

Kedia's largest bet remains Atul Auto (20-21% stake, ~₹286 crore), a three-wheeler maker. The stock surged 14% in a single day after Q2 FY26 PAT jumped 70% YoY to ₹9.2 crore, with revenue up 10%. Despite earlier dips, it's a standout performer.

Other key holdings:

- TAC Infosec (14.6% stake): Cybersecurity SME delivered 195% returns in the past year, though down 9% YTD.

- Elecon Engineering (1-1.1% stake): Up strongly, with analysts seeing 45% upside after multibagger runs.

- Neuland Laboratories, Precision Camshafts, Tejas Networks, Mahindra Holidays & Resorts: Mixed results—some up 69% on earnings, others down 24-51% YTD due to sector headwinds.

Overall, 9 stocks fell 15-50% in CY25, but rebounds in Q2 (e.g., Atul Auto +12% intraday) highlight resilience.

Why the Mixed Performance in 2025?

- Winners: Strong earnings in auto ancillaries and holidays (e.g., Mahindra Holidays PAT +69%).

- Laggards: Small-cap correction, valuation stretches, and sector-specific issues dragged stocks like Precision Camshafts (-24%) and others (-51%).

- Portfolio value dipped ₹71 crore earlier due to Atul Auto's temporary weakness, but recoveries followed.

Kedia trimmed stakes in underperformers like Global Vectra and Tejas Networks in Q1 FY26, showing discipline.

Investment Lessons from Vijay Kedia

- SMILE Framework: Hunt for scalable small-caps with massive potential.

- Patience Pays: Hold through volatility—his 100x winners took years.

- Management First: Transparent, execution-focused leaders are key.

- Diversify Smartly: Auto, engineering, pharma—avoid over-concentration.

- Learn from Dips: 2025 laggards are buying opportunities if fundamentals are intact.

What's Next?

Rumors of new bets in power and renewables, but Kedia stays fully invested in 12-15 stocks. With India’s growth story intact, his portfolio could rebound strongly in H2 2025.

Kedia's journey proves wealth creation is about conviction, not timing the market perfectly. As he says, "Bear markets create smart investors."

Do you track Kedia's picks? Which 2025 performer surprised you? Share in the comments! 📈

You May Also Like

Coal Ministry notifies rules doing away with CCO n...

Seeking to improve efficiency in the approval process towards accelerating coal production, the...

A soon-to-arrive FTA with Pacific economy takes In...

🧭 India’s Smart Trade Strategy: Why the FTA with a Pacific Economy MattersWhat’s the Big Deal?...

New labour codes: Gig firm clients likely to bear...

Gig platforms such as Swiggy and Eternal may transfer the increase in cost due to the implement...